Survey Results

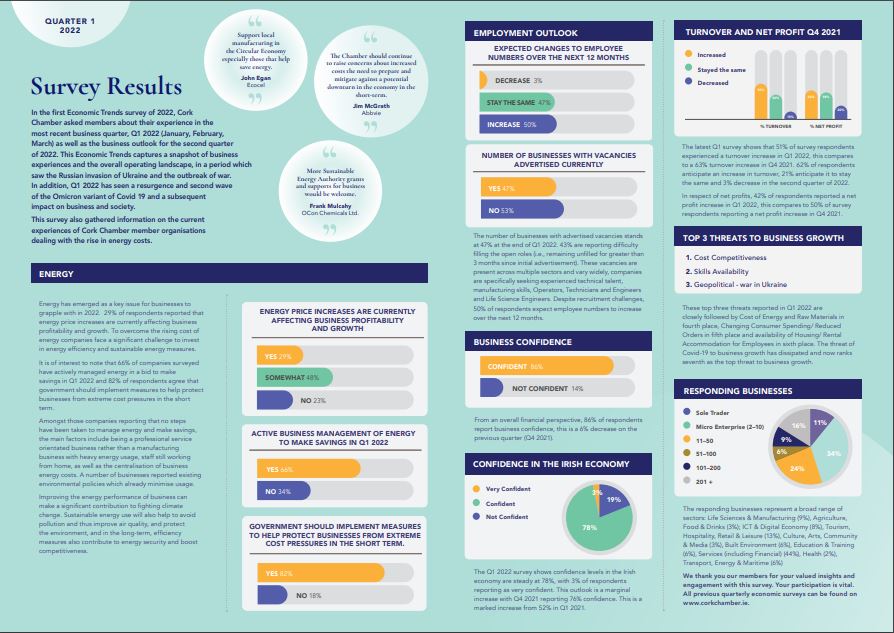

In the first Economic Trends survey of 2022, Cork Chamber asked members about their experience in the most recent business quarter, Q1 2022 (January, February, March) as well as the business outlook for the second quarter of 2022. This Economic Trends captures a snapshot of business experiences and the overall operating landscape, in a period which saw the Russian invasion of Ukraine and the outbreak of war. In addition, Q1 2022 has seen a resurgence and second wave of the Omicron variant of Covid 19 and a subsequent impact on business and society. This survey also gathered information on the current experiences of Cork Chamber member organisations dealing with the rise in energy costs.

|

|

|

|

|

|

It is of interest to note that 66% of companies surveyed have actively managed energy in a bid to make savings in Q1 2022.

82% of respondents agree that government should implement measures to help protect businesses from extreme cost pressures in the short term.

View all results

|

|

|

|

|

|

|

From an overall financial perspective, 86% of respondents report business confidence, this is a 6% decrease on the previous quarter (Q4 2021).

|

|

|

|

|

|

Expected Changes to Employee Numbers

Over next 12 Month Period

The number of responding businesses expecting to increase employee numbers in the coming months has decreased from 62% in Q4 2021, to 50% in this recent quarter. The high of 62% was reflective of expectations around businesses reopening as restrictions were easing.

|

| |

Number of Businesses with Vacancies

Currently Advertised

43% of respondent businesses with current vacancies are reporting difficulty filling the open roles (i.e., remaining unfilled greater than 3 months). These vacancies are present across multiple sectors and vary widely, companies are specifically seeking experienced technical talent, manufacturing skills, Operators, Technicians and Engineers and Life Science Engineers.

View more results

|

|

|

|

|

|

|

|

Top 3

- Cost Competitiveness

- Skills Availability

- Geopolitical - war in Ukraine

These top three threats reported in Q1 2022 are closely followed by Cost of Energy and Raw Materials in fourth place, Changing Consumer Spending/ Reduced Orders in fifth place and availability of Housing/ Rental Accommodation for Employees in sixth place. The threat of Covid-19 to business growth has dissipated and now ranks seventh as the top threat to business growth.

|

|

|

|

|

Browse Full Results Online

|

|

|

|

|